Payka

Buy now, pay later service

Paytree – a Polish fintech company needed an IT team to support the development of its Buy Now, Pay Later (BNPL) service – on frontend and backend side.

About the Buy Now Pay Later schema

We have provided a system that enables deferred payments.

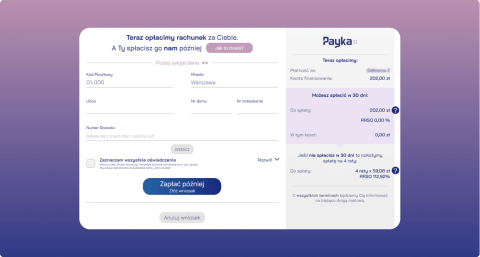

Payka allows users to pay (in Buy Now Pay Later schema) a utility bills such as energy, TV, Internet or telephone. The online payment process is fully automated, quick and simple: after selecting Payka method on the payment gateway, you enter your identification details, if you are recognized, you just accept terms with an SMS code. Otherwhise or if you use Payka first time, you are logging into your bank account to identify yourself through PSD2/AIS.

Payka’s payment process is fully secure. All transactions are encrypted and executed through secure servers and communication channels. The system is integrated with payment gateway provided by Blue Media, so that there is no need to integrate with each utility providers separately.

Good to know about our cooperation with Payka:

Team extension model with 5 backend developers

We collaborate on a team extension model, carrying out tasks together with an external front-end team. During the project, 5 backend developers were involved in the implementation of new functionalities.

So, what are its benefits to businesses?

As the name suggests, Buy Now Pay Later is a payment service that allows customers to delay the final bill. With Buy Now Pay Later, they can checkout without full immediate payment.

Speednet and Paytree have built a fully functional deferred payment system

Get to know us betterAfter leaving an email, we will get back to you within 24h

Schedule a free project estimate

Schedule a free project estimate

If you have a requirement you’d like to discuss with technical experts, schedule a free consultation to see if we’re a good fit to help.

Schedule a free project estimate

Schedule a free project estimate

If you have a requirement you’d like to discuss with technical experts, schedule a free consultation to see if we’re a good fit to help.